In the realm of banking, we’re in the throes of such a transformation. We’re experiencing an era marked by the meteoric rise of neobanks, all while traditional legacy banks grapple with the demands of the digital age. It begs the question: Neobanks vs. Legacy Banks – Which Will Reign Supreme in the Digital Age?

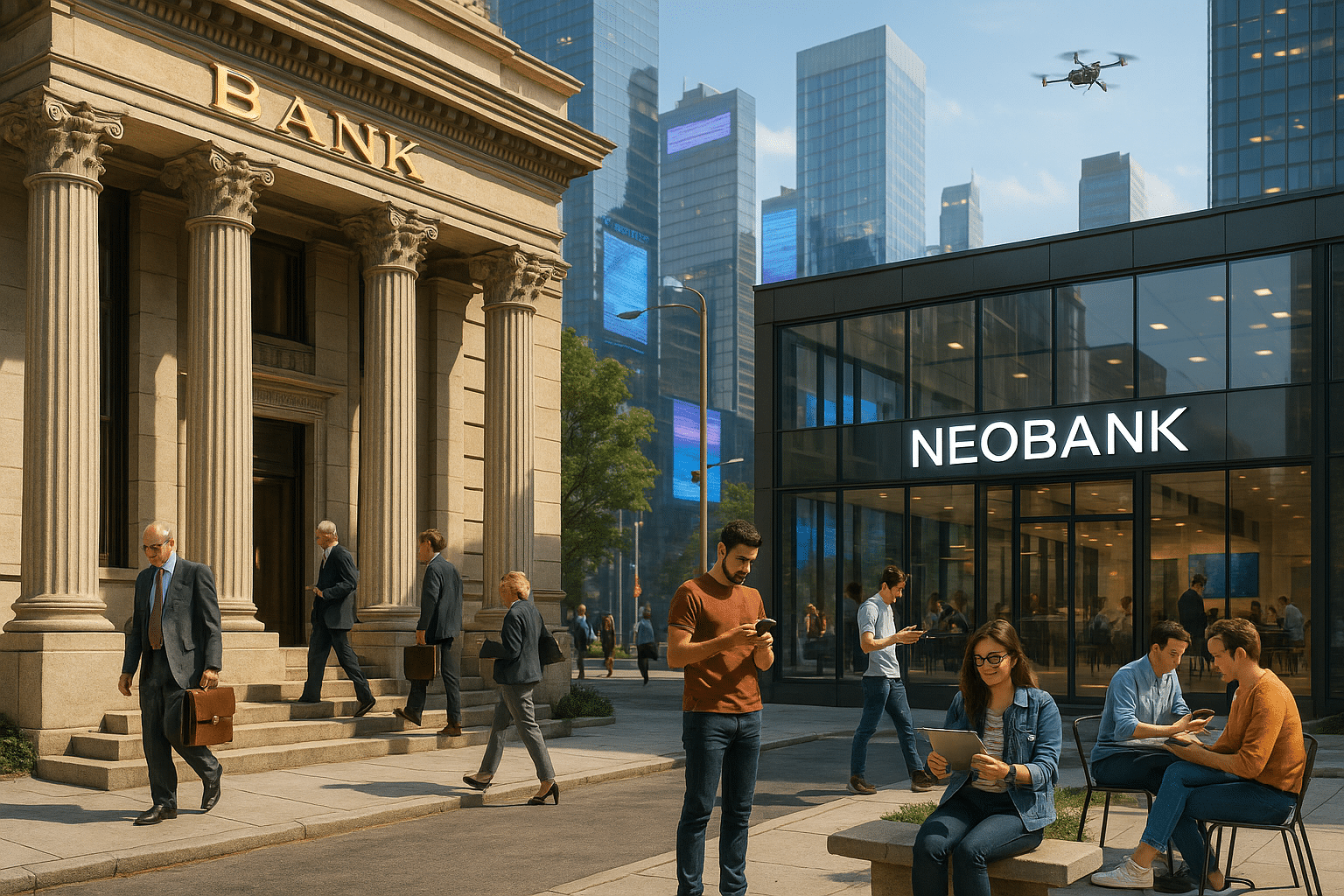

Before we delve into this hot-button issue, let’s ensure we’re all on the same page. Neobanks are digital-only financial institutions, providing online banking services without the presence of physical branches. Legacy banks, on the other hand, are established institutions that have been around for decades, or even centuries, and are trying to adapt to the evolving digital landscape. 🏦

The battle between these two financial powerhouses is poised to define the future of banking, and it’s one that’s being keenly watched by everyone, from industry insiders to customers pondering their banking choices. So, let’s strap in and take a deep dive into the world of neobanks and legacy banks, and the intense competition between them.

Our examination will encompass the main strengths and weaknesses of each type of bank, crucial factors that are shaping the competition, and the transformative technologies that could tilt the scales in one direction or the other. We’ll also explore key considerations for customers and the broader societal implications of this banking revolution.

The Strengths and Weaknesses of Neobanks and Legacy Banks

There’s no denying that neobanks are making waves. But are they inherently better than legacy banks? Or, are there areas where the traditional banks still hold the upper hand? We’ll take an in-depth look at the strengths and weaknesses of each, exploring factors such as customer experience, cost-effectiveness, trust and security, and the ability to innovate.

The Crucial Factors Shaping the Competition

As with any industry, the competition between neobanks and legacy banks is shaped by several crucial factors. Regulations, customer expectations, technological advancements, and economic conditions all play a role. Which factors are working in favour of neobanks, and which ones are helping legacy banks hold their ground? We’ll dissect these issues, and more. 💼

The Transformative Technologies at Play

Technology is undoubtedly at the heart of this battle. From AI to blockchain, and from big data to cybersecurity technologies, numerous innovations are influencing the competition between neobanks and legacy banks. We’ll explore these technologies, and how each type of bank is leveraging them for success.

Key Considerations for Customers and Broader Societal Implications

Finally, we’ll turn our attention to you, the customer. What does this competition mean for you, and how should you navigate the evolving banking landscape? We’ll also touch on the broader societal implications of this tussle between digital and traditional banking.

Intrigued? Excited? You should be! The future of banking is being written right now, and we’re all a part of it. So, join me as we explore the face-off between neobanks and legacy banks, and uncover which is most likely to reign supreme in the digital age. 💻🌐

The Revolution of Digital Banking: An Overview

As we march forward into the digital age, every industry is experiencing a seismic shift, and banking is no exception. Traditional banks with brick-and-mortar branches are being challenged by digital-only banks, commonly referred to as neobanks. These neobanks leverage technology to deliver a seamless, efficient, and customer-friendly banking experience. They promise lower fees, faster transactions, and a superior user experience. But can they truly dethrone legacy banks? Let’s delve into the world of digital banking to find out.

Before we dive deeper into the topic, watch this informative video titled “The Rise of Neobanks – How they are Changing the Finance Industry” by the YouTube channel FinTech Made Simple, which provides a brief introduction to neobanks and how they are disrupting the banking industry.

Understanding the key differences between these two types of banks is crucial to predict their future. So, let’s compare their features, advantages, and disadvantages in the table below:

| Banking Type | Key Features | Advantages | Disadvantages |

| Legacy Banks | Physical branches, in-person customer service, traditional banking services | Established trust, comprehensive service range, federally insured | Higher fees, less tech-savvy, slower transactions |

| Neobanks | App-based, digital-only, innovative services | Lower fees, real-time transactions, superior user experience | Less established trust, fewer services, not always federally insured |

The Changing Landscape of Banking

The rise of neobanks signals a paradigm shift in the banking industry. Traditional banks have been the stalwarts of the financial world for centuries, providing a wide range of services from checking and savings accounts to loans and insurance. However, with the advent of technology, these legacy banks are being challenged by agile, digital-only neobanks. The latter are gaining popularity for their customer-centric approach, leveraging technology to offer personalized, efficient, and cost-effective banking solutions.

However, legacy banks are not standing still. Many are investing heavily in digital transformation initiatives to stay relevant. They are developing digital banking platforms, improving their mobile apps, and even partnering with fintech companies to enhance their digital capabilities. Despite these efforts, they face an uphill battle to match the agility, cost-effectiveness, and customer-centricity of neobanks.

While the digital banking revolution is well underway, it’s worth noting that legacy banks still have a few aces up their sleeve. They have built trust with consumers over decades, if not centuries, of operation. This trust factor, coupled with a comprehensive range of services, can be a significant advantage over neobanks. However, whether this will be enough to maintain their dominance in the long run remains to be seen.

The Future of Banking: Neobanks vs. Legacy Banks

So, what does the future hold for neobanks and legacy banks? While it’s challenging to predict with certainty, a few trends are emerging.

Firstly, customer expectations are changing. The digital-native generation is looking for fast, convenient, and seamless banking experiences, which neobanks are well-equipped to provide. However, there are still sections of the population who prefer the traditional banking model, particularly for complex transactions or when they need personalized advice. Legacy banks can capitalize on this segment by providing a hybrid banking model that combines the best of both worlds.

Secondly, regulatory changes are likely to influence the future of banking. Neobanks often operate in a regulatory gray area, which can lead to challenges. On the other hand, legacy banks have to contend with a rigid regulatory framework that can stifle innovation. A balanced regulatory approach that encourages innovation while ensuring customer protection could be the key to a healthy banking ecosystem.

Finally, the future of banking could see a convergence of neobanks and legacy banks. Neobanks may start offering more comprehensive services, while legacy banks could become increasingly digital. In the end, the customer will be the ultimate winner, benefiting from the competition between these two types of banks.

To further understand the future of banking, watch “The Future of Neobanks: Are They the Next Big Thing?” by YouTube channel FinTech Explained.

Driving Factors for Neobanks and Legacy Banks

Several factors are driving the growth of neobanks. These include the increasing penetration of smartphones, widespread internet access, and changing consumer preferences. Moreover, the COVID-19 pandemic has accelerated the shift towards digital banking, as people avoid visiting physical branches. This trend is likely to continue even after the pandemic, as people become accustomed to the convenience of digital banking.

On the other hand, legacy banks are leveraging their strengths to stay relevant. These include a strong brand reputation, a wide range of services, and the trust factor. They are also investing in digital technologies and partnering with fintech companies to enhance their digital capabilities. However, they need to overcome several challenges, such as legacy systems, a rigid organizational structure, and a traditional mindset, to truly embrace digital transformation.

Despite the rapid rise of neobanks, it’s important to note that they are not without their challenges. These include a lack of profitability, regulatory hurdles, and a limited range of services. Furthermore, while they have made significant inroads in the retail banking sector, their impact on other sectors such as corporate banking and wealth management has been limited.

Conclusion

In conclusion, we have explored a substantial amount of ground over the course of this article. The intricacies of software engineering and information technology can often appear daunting, even to those immersed in the field. However, it is my hope that the clear, concise nature of my writing has aided you in understanding these complex topics.

We delved into the fundamental theories behind software engineering, exploring its different stages, from design to testing. We scrutinized the various methodologies used in the process of software development. The critical role of information technology in today’s digital age was underscored, along with an explanation of the importance of keeping up-to-date with emerging trends. We also discussed some of the challenges professionals in the field may face and offered some potential solutions.

The importance of software engineering and information technology cannot be overstated. These are fields that are central to our modern society, impacting everything from business operations to our personal lives. Understanding them, therefore, is not just beneficial—it’s crucial.

The depth and breadth of knowledge required may seem overwhelming, but don’t be discouraged. The journey of learning is a process, and every new concept you grasp is a step forward. Remember, the aim is not to become an expert overnight but to grow steadily, continually building upon what you have already learned.

I hope that this article has sparked a flame of interest in these subjects. If you’ve found it helpful, please don’t hesitate to share it with others who may also benefit. I welcome your comments and questions—your engagement enriches the learning experience for us all. You can also apply what you’ve learned here in your own endeavors, whether they be professional or personal.

If you wish to delve deeper into the topics covered here, I encourage you to check out the following resources. These are reliable and well-established sources of information in the field.

– Software Engineering Daily 📚

– Information Week 💻

– Computer Society’s Technical Committee on Software Engineering ⚙️

Remember, the key to mastering any complex field lies in breaking it down into manageable parts, and approaching it with curiosity and determination. Keep exploring, keep questioning, and keep learning. 🚀

Thank you for taking the time to read this article. I look forward to hearing from you and engaging in insightful discussions. Keep on learning, and until next time, happy coding! 💻💡🎓

References:

– Empirical Software Engineering

– Information and Software Technology

– IEEE Transactions on Software Engineering