Yes, you read that right. We are at the verge of a financial revolution, and as always, technology is at the forefront.

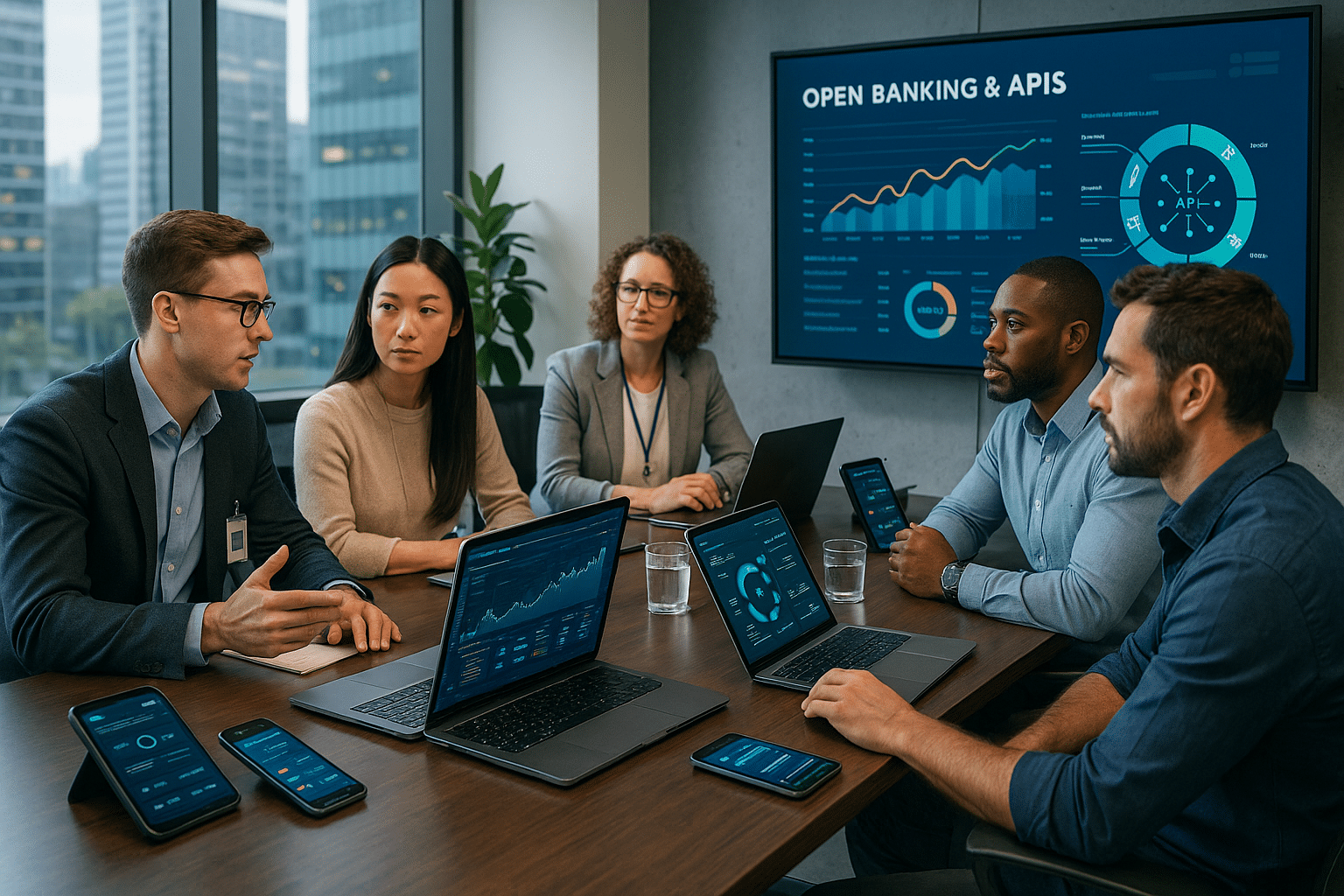

Now, you might be wondering, what’s all the buzz about Open Banking and API Ecosystems? Why are they said to be revolutionizing the financial industry? Well, let’s break it down. Open banking is a system that allows third-party developers to build applications and services around a financial institution. This is enabled through Application Programming Interfaces (APIs), which are sets of protocols that allow different software applications to communicate and share data.💡

Still sounds like tech-jargon? Don’t worry. We will dissect these concepts in an easy-to-understand manner, and delve into why they are pivotal in the evolution of the financial industry. By the end of this article, not only will you have a solid understanding of open banking and API ecosystems, but you will also comprehend their potential to disrupt traditional banking and financial services.

Our journey will commence with a brief overview of open banking – its genesis, its progression, and its current standing in the global financial landscape. We’ll delve into what open banking is, and how it is allowing financial institutions to break free from their traditional silos and adopt a more customer-centric approach. 🏦

Next, we’ll dive into the heart of open banking – the API ecosystems. We’ll explore how APIs are enabling seamless data sharing and integration, resulting in a paradigm shift from closed, proprietary systems to open, collaborative platforms. This section will be a revelation of sorts, demonstrating how APIs have become the cornerstone of modern financial services.

After a firm grasp of open banking and API ecosystems, we will then chart out their revolutionary potential. We’ll explore how they are empowering fintech startups to create innovative solutions, fostering competition, and paving the way for a more inclusive financial sector. 💼

Finally, we’ll take a look at the challenges and roadblocks in the adoption of open banking and API ecosystems. No revolution comes without its hurdles, and the open banking revolution is no exception. However, as we’ll discuss, these challenges are surmountable and the potential benefits far outweigh the initial difficulties.

There’s a lot to cover, but don’t be daunted. This article is designed to be informative yet engaging, technical but comprehensible. Whether you’re a banking professional, a tech enthusiast, or just curious about the future of finance, there’s something in here for everyone.

So let’s get started. The future is open, and it’s time to unlock the potential of open banking and API ecosystems. 🔓🚀

Introduction: Open Banking and API Ecosystems – The Power Duo

When we talk about the financial industry, the language of technology often intertwines with the jargon of finance. In today’s digital world, two terms have gained significant traction: Open Banking and API ecosystems. While both can seem quite intimidating at first, their complex facades are a facade for the potential they hold to revolutionize the financial industry. Open Banking and API ecosystems are like the dynamic duo in a superhero movie – one is a game-changer and the other amplifies its powers. To truly appreciate their role in the financial industry, we first need to understand them separately and then together as a unit.

Open Banking refers to the system where banks and other financial institutions provide access to their data in a secure and standardized format. This data, which includes customer banking data, transaction data, and other financial information, is made accessible to third-party developers via Application Programming Interfaces (APIs). The result? A transformative change in how banking services are delivered, with greater competition, innovation, and better customer experiences.

On the other hand, API ecosystems refer to the network of interactions between APIs, developers, and API consumers. They are the glue that holds digital services together, enabling different software applications to communicate, exchange data, and work together seamlessly. An effective API ecosystem promotes innovation, speeds up digital transformation, and creates new business opportunities.

Unlocking the Future: The Synergy of Open Banking and API Ecosystems

Now that we’ve established the individual roles of Open Banking and API ecosystems let’s look at how they interact. To describe their relationship, imagine the bank as a vast gold mine and APIs as the tools used to extract that gold. APIs enable third-party developers to tap into the bank’s wealth of data and build innovative applications and services around it. At the same time, Open Banking provides the regulatory framework and infrastructure needed to ensure this data extraction is done safely, securely, and with the customer’s consent.

With Open Banking and API ecosystems working together, the financial industry is opened up to a plethora of opportunities. Traditional banking services can be enhanced and made more customer-centric. New financial products can be developed, from personalized financial advice apps to smart budgeting tools. And all these can be achieved while ensuring the privacy and security of customer data.

But don’t just take my word for it. Let’s explore how Open Banking and API ecosystems have already started transforming the financial industry. Check out the table below for some of the real-world applications of Open Banking and APIs.

| Applications | Description |

|---|---|

| Personal Financial Management Tools | By accessing customer transaction data, these tools provide personalized budgeting advice, spending analyses, and savings goals. |

| Instant Payments | APIs enable real-time fund transfers between banks and other financial institutions, leading to faster, more convenient payments. |

| Automated Lending Platforms | By accessing customer banking data, these platforms can make instant credit decisions, simplifying the loan application process. |

How Open Banking and API Ecosystems are Reshaping Customer Experiences

One of the biggest advantages of Open Banking and API ecosystems is their impact on customer experiences. By breaking down data silos, they enable the delivery of a seamless, integrated banking experience. Customers can now access multiple financial services from a single platform, saving them the hassle of dealing with multiple interfaces.

Furthermore, Open Banking and APIs enable the delivery of personalized financial services. With access to customer banking data, third-party developers can build applications that cater to the specific needs of each customer. For example, a personal financial management tool can analyze a customer’s spending patterns and provide tailored budgeting advice. Similarly, a lending platform can make loan recommendations based on a customer’s financial history.

To get a glimpse of how Open Banking and APIs can enhance customer experiences, watch this video by IBM Banking Industry: “Open Banking Explained” on YouTube. The video provides a simple, yet comprehensive explanation of Open Banking and its implications for customers.

Overcoming Challenges: Security, Privacy, and Regulation

While Open Banking and API ecosystems hold immense potential, they also present a unique set of challenges. Topmost among these are issues related to data security and privacy. As banks open up their data to third-party developers, they need to ensure this data is handled securely and with respect for customer privacy.

Regulation is another major challenge. Different countries have different regulatory frameworks for Open Banking. In the European Union, for example, the Revised Payment Services Directive (PSD2) regulates Open Banking activities. In other countries, however, such regulatory frameworks may not exist, creating uncertainty and risks for both banks and third-party developers.

Despite these challenges, the future of Open Banking and API ecosystems looks promising. With the right regulatory frameworks and security measures in place, they can unlock a world of opportunities for the financial industry. So, as we stand at the cusp of this new era, the only question is: are we ready to embrace it?

Conclusion

In concluding, I believe it is paramount to reiterate the salient points we have explored throughout this comprehensive article. Our main focus was on the intricate aspects of technology and engineering – particularly within the realms of software development and IT.

We began by taking a deep dive into the theory behind software development, from the basics of coding to the more complex principles of systems design. We outlined the importance of understanding the fundamental coding languages like Python, Java, and C++. This foundation, we discussed, is the cornerstone of any successful software engineering project. Without a solid grasp of these basic tools, the more complex aspects of development can become overwhelming.

Moving forward, we ventured into the more advanced topics of systems design and architecture. We explored the importance of good design, how it affects the overall efficiency of a software, and its impact on the user experience. Here, we delved into the concepts of user interface (UI) and user experience (UX), both vital to ensuring a seamless interaction between the software and its users.

Next, we pivoted our discussion to the world of Information Technology (IT). We highlighted the significance of IT in today’s digital era, where businesses and organizations heavily rely on IT systems for their day-to-day operations. Whether it’s data management, network infrastructure, or cybersecurity, the role of IT cannot be understated.

From there, we expanded our conversation to the broader implications of technology and engineering on society. We underscored the growing concern over cybersecurity and the paramount importance of safeguarding sensitive data. Additionally, we touched upon the ethical implications of technological advancement, emphasizing the necessity of responsible innovation.

After such an enlightening discourse, I hope you now have a deeper understanding of the intricate nuances of software development and IT. My ultimate goal was to present these complex subjects in an accessible and comprehensible manner. Remember, while the technology landscape may seem daunting, with continuous learning and persistent application, you too can navigate it confidently.

If you found value in this article, I encourage you to share it with your peers. Let’s foster a community where knowledge sharing and collective growth are celebrated. Feel free to comment below with your thoughts or any questions you may have. Your engagement fuels our motivation to continue providing valuable content. 😊

To further your understanding, consider exploring some of these reputable sources that I’ve utilized during my research:

1. [Software Engineering Institute, Carnegie Mellon University](http://www.sei.cmu.edu/)

2. [The Institute of Electrical and Electronics Engineers (IEEE)](https://www.ieee.org/)

3. [Association for Computing Machinery (ACM)](https://www.acm.org/)

As we move forward in our technological journey, I leave you with a quote by Alan Kay, a pioneer in computer science, who once said, “The best way to predict the future is to invent it.” So let us continue to learn, innovate, and shape our future.

In the end, our exploration of technology and engineering is not just about understanding the mechanisms of software or IT systems. It’s about harnessing this knowledge to create solutions, foster innovation, and ultimately, drive progress in our society. 💡

Until next time, happy learning!

Tags: #SoftwareDevelopment, #InformationTechnology, #Coding, #SystemsDesign, #UserInterface, #UserExperience, #CyberSecurity, #DataProtection, #EthicsInTechnology.