But we won’t be discussing traditional banking or investment strategies. Instead, we’ll be venturing into the digital realm, focusing on the intersection of finance and technology. Specifically, we’ll be discussing subscription models in modern digital banking and how they can be the key 🔑 to unlocking financial freedom. It’s a thrilling, timely topic, and I’m glad you’re joining me on this journey. 🚀

The Evolution of Banking: From Brick and Mortar to Digital 🌐

First, we’ll be taking a look back to trace the journey of banking systems. As we all know, banking has come a long way from the days of brick and mortar structures. The advent of the internet and mobile technology has revolutionized how we transact and manage our finances. This evolution not only changed the consumer behavior but also transformed the business models in the banking industry. Digital banking is now the new norm, and subscription models are one of the innovations that have emerged from this shift. We’ll delve into the intricacies of these models, explaining their operation and benefits.

The Power of Subscription Models 💪📈

Subscription models in digital banking have taken center stage, mainly due to their potential to create steady revenue streams while offering customers the convenience and flexibility they crave. In the digital age, where instant gratification is a must, subscription models are tailored to provide seamless, user-friendly experiences. The logic is simple: pay a recurring fee and get access to a range of financial services, all at your fingertips. 📲 But how do these models facilitate financial freedom? That’s something we’ll be getting into.

Financial Freedom: A Journey, Not a Destination 🗺️📍

What does it mean to achieve financial freedom? It’s a term that’s thrown around quite a bit, especially in the world of personal finance and investment. Financial freedom is not just about being wealthy; it’s about gaining control over your financial life – knowing where your money is going and having the ability to make choices that allow you to enjoy life while building wealth. It’s a journey, not a destination. In our discussion, we’ll explore how digital banking, and more specifically subscription models, can put you on the right track towards achieving this.

Unlocking the Future of Finance 🔓🏦

In the concluding sections of the article, we’ll be taking a look at the future of finance. With the rapid technological advancements, digital banking is continually evolving, and subscription models are likely to be a significant part of this evolution. We’ll discuss the trends, challenges, and opportunities that lie ahead, providing insights that will help you navigate this dynamic landscape.

Whether you’re a finance guru, a tech enthusiast, or simply someone who’s curious about modern banking, this article promises to be an enlightening read. So, buckle up and get ready to delve into the world of digital banking, exploring the power of subscription models and their potential to unlock financial freedom. Here’s to a great journey! 🥂

The Changing Landscape of Digital Banking

As we traverse the digital age, banking has been significantly impacted by the vast technological changes. Traditional banking models are increasingly replaced with advanced digital banking systems, bringing a whole new level of convenience, accessibility, and speed to customers worldwide. One such groundbreaking shift is the adoption of the subscription model in digital banking, providing limitless opportunities for financial freedom. Let’s dive into this fascinating topic and uncover the power of subscription models in modern digital banking.

The subscription model has long been associated with industries such as entertainment, retail, and software services. Think of Netflix, Amazon Prime, and Adobe Creative Cloud – these are prime examples of businesses capitalizing on the subscription model to provide customers with uninterrupted services for a regular fee. In the banking sector, this concept is still relatively new, but it’s fast gaining momentum.

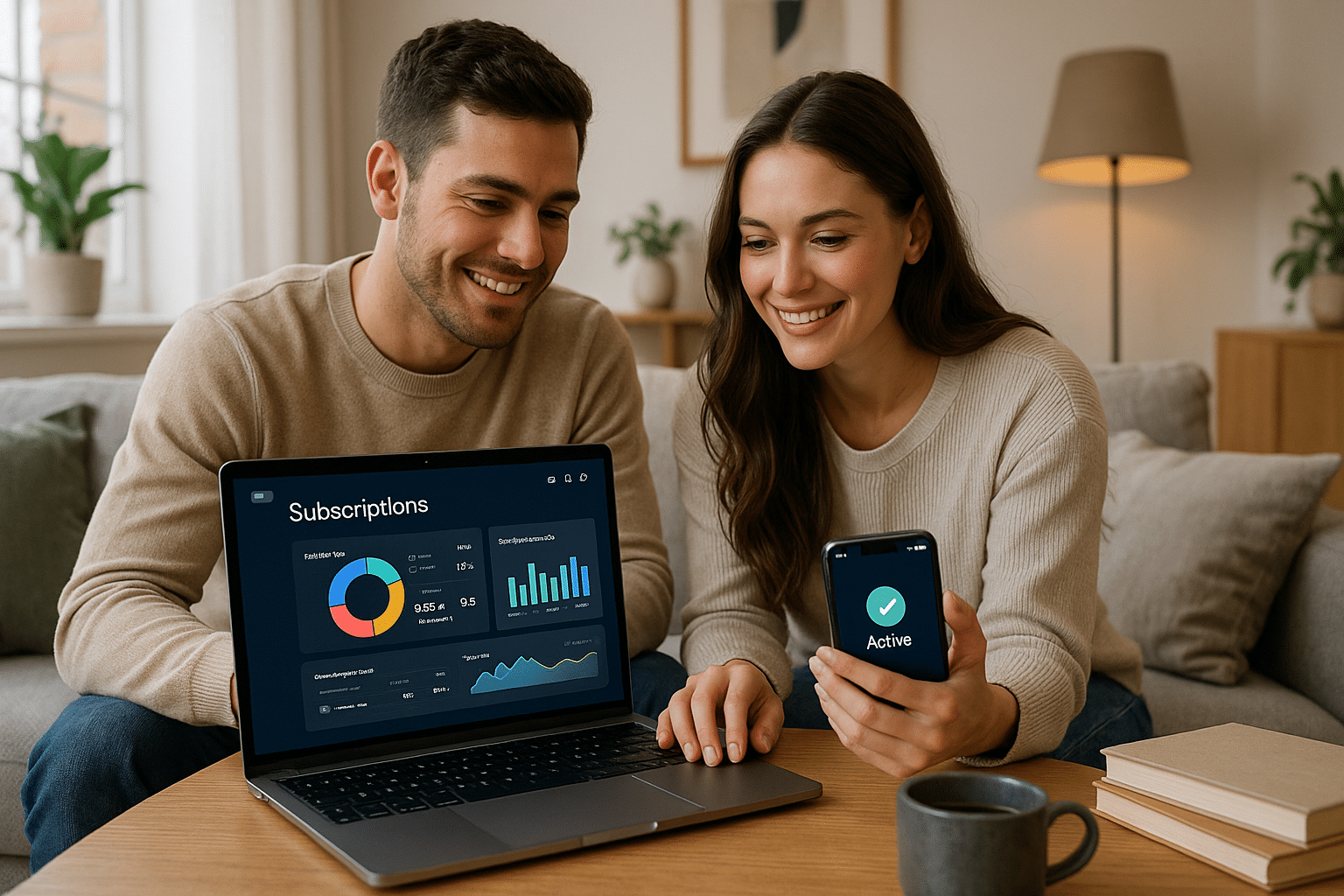

Subscriptions in digital banking typically offer a multitude of financial services for a monthly or annual fee, providing customers with value and convenience. But how does this model truly unlock financial freedom for the average user? We’ll explore that next.

Financial Freedom Through Subscription Models

One of the biggest advantages of subscription models in digital banking is the ability to manage financial health effectively. Users can access a variety of financial services such as bill payments, money transfers, investments, insurance, and loans under one roof. This removes the need to engage with multiple financial institutions, leading to easier management and potentially lower costs.

Moreover, subscription-based digital banking services often include features like budgeting tools, savings goals, and financial education resources. These features empower users to take control of their finances and make informed decisions. In addition, some digital banks also offer perks such as cashback on transactions, free ATM withdrawals, and discounts on various services, adding more value to the subscription.

To illustrate the advantages of subscription models, let’s look at a comparative table between traditional banking and subscription-based digital banking.

| Banking Type | Service Accessibility | Cost Efficiency | Financial Management Tools |

|---|---|---|---|

| Traditional Banking | Limited by branch operating hours and location | Multiple fees for different services | Typically not offered |

| Subscription-Based Digital Banking | 24/7 access from anywhere | One regular fee for multiple services | Commonly included in the subscription |

Refer to this video by FinextraTV titled “The Future of Banking: Subscriptions” for a detailed explanation on the impact of subscription models on the banking industry.

Overcoming Challenges in Subscription Models

While the subscription model in digital banking presents a plethora of benefits, it’s not without challenges. The primary concerns are around security, regulatory compliance, and customer engagement.

In terms of security, digital banks must ensure they have robust mechanisms in place to protect customer data and transactions. Compliance with regulations is also crucial as banking is a highly regulated industry. Regulatory bodies are continuously adapting to the changes brought about by digital banking, and digital banks must stay abreast with these changes to ensure they remain compliant.

Engaging customers is another challenge. Unlike traditional banking where customers might interact with bank staff, digital banking is mostly self-service. Hence, digital banks must design user-friendly interfaces, offer excellent customer support, and ensure their services provide real value to keep customers engaged.

As the digital banking landscape evolves, innovative solutions continue to emerge to address these challenges. AI and machine learning technologies, for instance, are being leveraged to enhance security and compliance. Meanwhile, personalization and gamification techniques are being employed to improve customer engagement.

The Future of Subscription Models in Digital Banking

Looking ahead, the future of subscription models in digital banking looks promising. As more and more consumers become comfortable with the idea of digital banking, the demand for subscription-based services is likely to rise. These services cater to the digital-savvy generation who value convenience, speed, and control over their finances.

Furthermore, as technologies advance, we can expect to see even more sophisticated features in subscription-based digital banking services. From advanced AI-powered financial advice to blockchain-based security features, the possibilities are endless.

In conclusion, subscription models in digital banking hold the key to unlocking financial freedom. While there are challenges to be addressed, the benefits far outweigh them. With continuous innovation, the banking industry is set to redefine the way we manage our finances.

Explore More About Subscription Models

If you’re intrigued by the potential of subscription models in digital banking, I encourage you to delve deeper into this topic. There are numerous resources available online to expand your understanding. A video I highly recommend is “Why Subscriptions Are the Future of Banking” by 11:FS. It provides a comprehensive overview of the concept and discusses its implications for the future of banking.

Subscription models are redefining the banking industry, bringing a wave of financial freedom for users. As we move forward, it will be interesting to see how this model continues to evolve and reshape our financial experiences. So, stay curious, stay informed, and embrace the digital revolution in banking!

Conclusion

After an extensive and comprehensive discussion on the intricate aspects of Software Engineering and Information Technology, we have reached the closing remarks of our discussion. Throughout the course of this article, our journey has unfolded various facets of these intricate disciplines, diving deep into the core principles and their real-world applications. From understanding the theoretical constructs to exploring their practical implications, we have covered a wide spectrum, providing you with a panoramic view of Software Engineering and IT.

The primary aim of this article was to elucidate the complex concepts of Software Engineering and IT in a manner that’s understandable, comprehensive, and useful. Our discussions ranged from the core principles of these fields, the tools and technologies utilized, to the future trends and career prospects. Moreover, we also highlighted the significance of these disciplines in the current digital era, emphasizing their role in shaping the future of technology.

Whether it was about deciphering the complex coding languages, mastering the software development methodologies, or comprehending the multi-faceted aspects of IT infrastructure, we endeavored to offer you insights that are both enriching and enlightening. Our discussions were heavily backed by reliable sources like IBM’s Software Engineering page and Microsoft’s Research on Software Engineering, ensuring the credibility and validity of the information shared.

In the realm of Software Engineering and IT, constant learning and adaptability are the keys to success. As these fields continue to evolve at a rapid pace, staying abreast of the latest developments is crucial. With this article, we aimed to equip you with essential knowledge and perspectives, thereby empowering you to embark on a successful journey in these dynamic fields.

In conclusion, the domains of Software Engineering and IT hold immense potential and offer exciting opportunities. The knowledge you’ve acquired through this article can serve as a strong foundation for your future endeavors in these disciplines. We encourage you to delve deeper into these fields, explore their vast dimensions, and leverage your learning to create innovative solutions and shape the future of technology.

Before we sign off, we’d like to invite you to share your thoughts and perspectives. Feel free to leave your comments below 👇. Additionally, if you found this article beneficial, do consider sharing it with your peers and colleagues 🔄.

Let’s continue our learning journey, exploring new horizons, and unraveling the mysteries of Software Engineering and IT. Stay tuned for more insightful discussions. 🚀

REFERENCES

1. IBM. Software Engineering. Available at: https://www.ibm.com/topics/software-engineering

2. Microsoft. Software Engineering Research. Available at: https://www.microsoft.com/en-us/research/research-area/software-engineering/