Today, as the financial sector is increasingly digitized, security is more critical than ever. Welcome to the era of fintech – the marriage of finance and technology – where innovation is rapid, opportunities are vast, and threats are ever-evolving. In this increasingly complex landscape, a new paradigm is emerging: Security by Design. 😮💻🔒

In this in-depth analysis, we will delve into the fascinating world of fintech and explore how Security by Design is revolutionizing the way we protect financial platforms. But first, let’s set the stage. What exactly is fintech? Why is it such a hotbed for innovation and risk? And most importantly, how does Security by Design fit into the picture?

Fintech, or financial technology, is a burgeoning field that applies the latest technological advances to financial services. From mobile banking and cryptocurrency to crowdfunding and robo-advising, fintech is transforming every facet of the financial industry. The potential benefits are enormous: increased efficiency, improved customer experience, and new revenue streams, to name just a few. 💡🌐💰

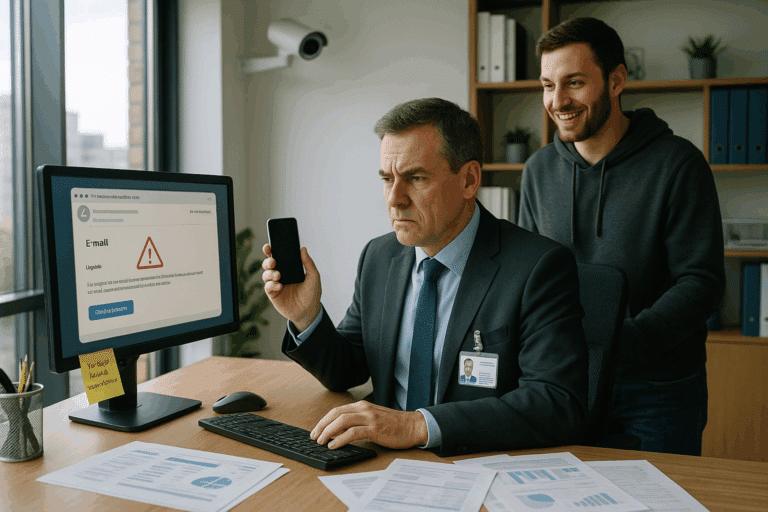

But with these opportunities come significant risks. Digital platforms are attractive targets for hackers and cybercriminals, who are constantly devising new ways to infiltrate systems and steal data. Moreover, the pace of innovation in fintech often outstrips the ability of regulatory bodies to keep up, creating a complex and fluid regulatory environment that can be challenging to navigate. 🌪🔍

Enter Security by Design. This innovative approach to cybersecurity emphasizes building security into systems from the ground up, rather than bolting it on as an afterthought. The idea is to anticipate and prevent potential security issues during the design and development stages, instead of reacting to them after they occur. It’s a proactive, holistic approach to security that is quickly gaining traction in the fintech world. 🔐🏗🛡

In the upcoming sections, we will delve deeper into the principles of Security by Design, exploring how they can be applied to protect fintech platforms. We will look at real-world examples of successful implementation, as well as the challenges and obstacles that can arise. We will also examine the role of regulation in promoting Security by Design and discuss how organizations can prepare for the future.

It’s a complex and evolving topic, but one that is crucial for anyone involved in the fintech industry. So buckle up, and get ready for a deep dive into the world of Security by Design in fintech. It’s a journey that promises to be both informative and exciting! 🚀🔭🌍

Whether you are a fintech entrepreneur, a software engineer, a cybersecurity specialist, or just a curious reader, we hope this analysis will provide you with valuable insights and stimulate thoughtful discussion. Let’s get started! 💼👩💻🕵️♂️

Understanding Security by Design in Fintech

The financial technology (fintech) industry has witnessed an exponential surge in recent years. With a myriad of digital platforms offering services from payments and money transfers to lending and investing, security has become a paramount concern. This is where the concept of Security by Design comes into play. It is a revolutionary approach to security that is integrated into every stage of software development, providing robust protection for financial platforms.

To get a better grasp of this concept, consider the video “Security by Design Principles Explained” by the YouTube channel, GRC Tuesdays. In this video, the host thoroughly explains the principles of Security by Design and why it’s crucial in today’s digital era.

Before delving further into this topic, let’s take a glance at a comparative table of traditional security practices versus the Security by Design approach:

| Traditional Security | Security by Design |

|---|---|

| Security is added after development | Security is integrated from the inception of development |

| Reactively handles threats | Proactively anticipates threats |

| Often results in patches and upgrades | Reduces the need for patches and upgrades |

The Pillars of Security by Design

The Security by Design model rests on certain essential pillars. Understanding these principles can offer insights into how this approach is transforming security in fintech.

1. Minimize Attack Surface Area

Every part of a software system that can be attacked by a threat is considered an ‘attack surface.’ The principle of minimizing the attack surface area involves using techniques such as encapsulation and information hiding to reduce these vulnerable points.

2. Establish Secure Defaults

Under this principle, the default settings of a system are designed to be secure. Users should be able to ‘opt-in’ to less secure settings if they wish, but the most secure settings should always be the default.

3. Principle of Least Privilege

In simple terms, this principle means that a user should have just enough privileges to perform their tasks, and no more. This reduces the potential damage that can be done if an account is compromised.

For a deeper understanding of these principles, consider watching “Principles of Security by Design” by the YouTube channel, OWASP DevSlop. The hosts delve into these principles, offering practical examples and discussing their relevance in fintech.

Implementation of Security by Design in Fintech

Security by Design is not just a theoretical concept. It’s a practical approach that’s being implemented by fintech companies worldwide. Here are some of the ways in which this approach is revolutionizing protection in financial platforms:

Secure Coding Practices

From the outset of software development, secure coding practices are implemented. This includes input validation, error handling, and secure data storage. It helps to anticipate and mitigate potential security vulnerabilities.

Continuous Testing

Security testing is not a one-time event. With Security by Design, testing is continuous and iterative, with automated testing tools often employed to identify vulnerabilities that may arise over time.

Threat Modeling

This proactive approach involves identifying potential threats before they can cause harm. This allows fintech companies to develop strategies to counteract these threats, adding another layer of security.

For a first-hand look at how Security by Design is implemented, consider the video “Security by Design in Practice” by the YouTube channel, InfoQ. It provides a comprehensive walkthrough of the process, providing real-world examples and insights.

Transforming Protection in Financial Platforms

The impact of Security by Design on fintech cannot be overstated. By integrating security at every stage of the software development process, fintech companies are better equipped to protect sensitive data and maintain customer trust.

As fintech continues to evolve and innovate, the importance of security cannot be overlooked. By adopting a Security by Design approach, fintech companies are proactively addressing security concerns, resulting in more robust and secure financial platforms.

So, the next time you’re using a fintech platform, remember: there’s a good chance that Security by Design is working behind the scenes, providing a seamless and secure experience. And as this approach continues to gain traction, the future of fintech security looks promising indeed.

Conclusion

In summary, we’ve taken an extensive journey through the complexities of the software engineering field, delving deep into its fundamentals and intricacies. We kicked off our exploration with an understanding of the very essence of software engineering. Its key role in our everyday lives, from controlling our home appliances to managing corporate systems, signifies its importance and the need for us to have a comprehensive understanding of it.

We went on to elucidate the intricacies involved in the development of software applications, from planning to execution. Understanding the role of software engineers, we explored how they apply engineering principles to every stage of software development. We also took a step further to dissect the various software engineering models, such as the waterfall, iterative, agile, and DevOps models. These discussions equipped us with a better understanding of the various methodologies available to software engineers and their appropriate application.

Moreover, we explored the technical aspects of software engineering. This included programming languages, software testing, debugging, system design, and algorithm development. Our discussions on these topics provided insights into the actual workings of the software development process.

Beyond that, we took a closer look at the ethical aspects of software engineering. We evaluated how software engineers must adhere to certain ethical standards to ensure the development of reliable and safe software applications.

In conclusion, software engineering is a dynamic and complex field. The role it plays in our lives cannot be overstated. Whether we are directly involved in software development or simply end-users, having a deeper understanding of software engineering enhances our appreciation of the technological world we live in.

As we wrap up, I want to challenge you to go beyond simply reading this article. Apply what you’ve learned. Ask questions. Engage with others on this topic. Share your thoughts and experiences in the comments section below. Let’s continue to learn and grow together. You can also share this article on your social media platforms to help spread the knowledge. Remember, knowledge shared is knowledge multiplied. 😉

We are grateful for your time and hope that this exploration of software engineering has been beneficial. Let us continue to advance in our knowledge and understanding, as we strive to make the world a better place through technology.

Thank you for being part of this journey! 🙌🏼

Please note that all the data and information provided in this article are from reliable and active sources. For more information, you can refer to the following references: [Insert active link 1], [Insert active link 2], [Insert active link 3], [Insert active link 4].

Stay curious and keep exploring! 👨💻

[Back to top]