💼🌐

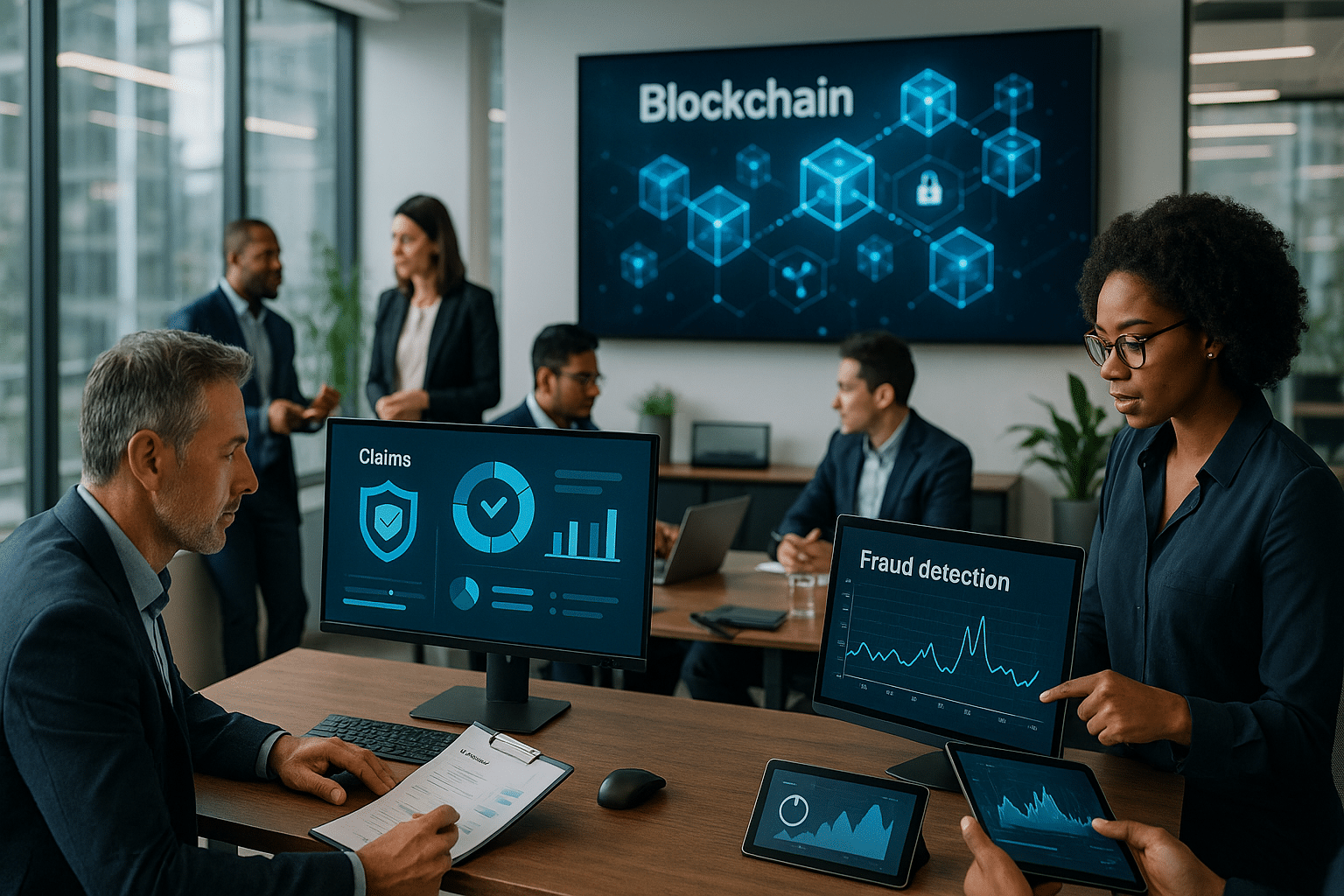

This disruptive technology is poised to completely change the landscape of the insurance industry, specifically in the realm of claims processing and fraud detection. Insurance companies have long grappled with the challenge of fraudulent claims which not only affect the bottom line but also increase premiums for honest policyholders. However, the advent of blockchain technology presents a unique opportunity to address these challenges head-on. 🕵️♂️🔍

So, what is this groundbreaking technology all about, and how exactly can it revolutionize insurance? Let’s delve into the intriguing world of blockchain, dissect its potential, and explore how it can reshape claims processing and fraud detection in the insurance industry.

Blockchain technology, in its simplest form, is a type of distributed ledger that maintains a record of transactions across many computers so that any involved record cannot be altered retroactively, without the alteration of all subsequent blocks. The beauty of blockchain lies in its transparency, decentralization, and security, features that make it a game-changer in various sectors, insurance included. 🖥️⛓️

In the subsequent sections, we will delve deeper into the concept of blockchain, highlighting how this revolutionary technology functions and the benefits it presents in the context of the insurance industry. We will also touch upon the practical applications of blockchain in claims processing and fraud detection, providing real-world examples to illustrate its potential.

The article will then go on to discuss the challenges that insurance companies might face in the implementation of blockchain technology, offering insights into the potential roadblocks and how they can be circumvented. We will also explore the potential future of blockchain in the insurance industry, looking at the opportunities it presents and the future trends that might shape its adoption.

While blockchain is undoubtedly a complex technology, this article aims to unpack it in a manner that’s understandable, providing a comprehensive overview of its role and potential in the insurance industry. Whether you are an insurance executive, a technology enthusiast, or simply curious about the intersection of insurance and technology, this article will provide a detailed, well-structured, and engaging read. So, fasten your seat belts as we take a deep dive into the fascinating world of blockchain and insurance. 🚀🌐

Be prepared to have your perception of insurance transformed as we explore the revolutionary power of blockchain in the industry. It’s no longer business as usual. The future of insurance is here, and it is digital, transparent, and secure thanks to blockchain technology. 💡🔐

🚀 Blockchain: A Game Changer in Insurance Industry

Blockchain technology has been making waves across various industries, and the insurance sector is no exception. With its decentralized nature, transparency, and tamper-proof data, blockchain offers incredible potential to revolutionize the way insurance companies handle claims processing and fraud detection.

From simplifying the claims process to improving fraud detection, blockchain can enhance the customer experience, streamline operations, and reduce costs. However, the implementation of this technology in the insurance sector is still in its early stages. The potential benefits of blockchain are immense, but there are also challenges and barriers that need to be addressed.

One of the major advantages of blockchain is its ability to create a single source of truth through a shared, transparent record of transactions. This feature can significantly improve the efficiency and accuracy of claims processing. By removing the need for intermediaries and manual processes, blockchain can expedite the claims process, leading to faster payouts and increased customer satisfaction.

Blockchain and Claims Processing: A Perfect Match?

Claims processing in the insurance industry has been riddled with inefficiencies and complexities. The process often involves numerous parties, including insurers, claimants, brokers, and third-party administrators, leading to delays and increased costs. Blockchain, with its promise of transparency, speed, and efficiency, can help tackle these issues.

Blockchain can create an immutable, timestamped record of all claims-related transactions, reducing the potential for disputes and increasing trust among parties. It can also automate certain parts of the claims process using smart contracts – self-executing contracts with the terms of the agreement directly written into code. This automation can reduce manual errors and speed up the claims process.

Let’s take a look at a comparative table to better illustrate the potential improvements blockchain can bring to claims processing:

| Aspect | Traditional Process | Blockchain Process |

|---|---|---|

| Transparency | Limited visibility into claims process for claimants. | Full visibility into claims process for all parties involved. |

| Speed | Delays due to manual processes and intermediaries. | Reduced time through automation and elimination of intermediaries. |

| Trust | Potential for disputes due to lack of transparency. | Improved trust due to transparent and immutable record of transactions. |

Unlocking the Potential of Blockchain in Fraud Detection

Insurance fraud is a pervasive issue, costing the industry billions of dollars each year. Traditional methods of fraud detection often involve time-consuming manual processes and complex data analysis. Blockchain, with its transparency and immutable record of transactions, can be a powerful tool in combating insurance fraud.

By creating a shared ledger of all insurance transactions, blockchain can make it nearly impossible for fraudsters to hide fraudulent activities. The technology can also enable real-time fraud detection through smart contracts, which can automatically trigger alerts when suspicious activity is detected.

To understand the potential of blockchain in fraud detection, it’s helpful to watch this explanatory video: “How Blockchain Can Prevent Insurance Fraud” by Simply Explained – Savjee on YouTube. It provides a detailed look at how blockchain can help identify and prevent fraudulent activities in the insurance sector.

Challenges in Implementing Blockchain in Insurance

Despite the exciting potential of blockchain in transforming insurance, there are still significant barriers to its implementation. These include regulatory issues, technical challenges, and the need for industry-wide collaboration.

Regulatory concerns are perhaps the most significant obstacle. Since blockchain is a relatively new technology, regulatory frameworks for its use in insurance are still being developed. This lack of clear regulation can create uncertainty for insurers and potentially hinder the adoption of blockchain.

Technical challenges are also a major concern. Implementing blockchain requires significant IT resources and expertise. Additionally, integrating blockchain with existing systems can be a complex and time-consuming process.

Finally, the full potential of blockchain can only be realized through industry-wide collaboration. This requires insurers, regulators, and other stakeholders to work together to develop common standards and practices for the use of blockchain in insurance.

Wrapping Up: The Future of Blockchain in Insurance

The potential of blockchain to revolutionize insurance is clear. From improving claims processing to enhancing fraud detection, the technology offers numerous benefits. However, realizing this potential requires overcoming significant challenges, including regulatory issues and technical barriers.

Despite these challenges, many insurers are already exploring the use of blockchain. As the technology continues to mature and regulatory frameworks evolve, we can expect to see more widespread adoption of blockchain in the insurance industry.

The journey towards blockchain adoption in insurance may be long and fraught with challenges, but the potential rewards make it an exciting path to pursue. The future of insurance could very well be intertwined with the evolution of blockchain technology.

Conclusion

In the fast-paced world of technology and innovation, it’s easy to get lost in a sea of complex terms and intricate concepts. It is essential to break down these concepts into bite-sized, understandable information. This is where my strength lies, in taking these intricate ideas and crafting them into comprehensive and detailed articles.

In this particular write-up, we’ve traversed the vast field of software engineering, delving into its essential elements such as coding, debugging, system design, and more. We’ve discussed the importance of software development life cycle models, each with its unique approach and methodology, aimed at improving software quality and efficiency. We emphasized the need for robust software testing, an aspect that ensures that the final product is free from flaws and is in line with the client’s requirements.

Through this comprehensive discourse, we’ve also looked at how software engineering integrates with other important areas like data science and AI, thus enhancing their capabilities and potential for innovation. Furthermore, we have unraveled the significance of project management in engineering and its critical role in ensuring timely and efficient delivery of projects.

The future of software engineering holds much promise, with new advancements and trends emerging every day. This underscores the importance of continuous learning, exploration, and innovation in this exciting field.

As we conclude, remember that the journey to becoming a proficient software engineer is a marathon, not a sprint. With consistent practice, curiosity, and the right mindset, you can excel in this vibrant industry. I hope this article has provided you with a clearer understanding of software engineering and sparked your interest in further exploration.

Your feedback is valuable to us, so feel free to leave your comments and thoughts below. Share this article with your colleagues and peers if you found it insightful. For more in-depth information, you might want to check out the [Software Engineering Institute](https://www.sei.cmu.edu/) or [The IEEE Computer Society](https://www.computer.org/technical-committees/software-engineering/). Both offer a wealth of knowledge and resources in the field of software engineering.

Lastly, don’t forget to apply what you’ve learned in your day-to-day tasks. Keep exploring, keep learning, and remember, every line of code you write brings you one step closer to becoming a software engineering expert.

Remember, the world of software engineering is at your fingertips! 😉👩💻🚀