With our society becoming increasingly digital, it’s no surprise that the world of finance is evolving too. One of the latest developments in this field is the rise of Robo-advisors — software-driven platforms designed to automate investment management and financial planning. But what exactly are Robo-advisors, and how can they help secure your financial future? 🤖💰

That’s what we’re going to explore in this detailed, yet straightforward guide. We will delve into the world of Robo-advisors, their benefits, potential drawbacks, and how they can help you prepare for retirement.

Retirement planning is no small task. It involves various factors, including savings, investments, healthcare costs, and potentially even estate planning. And with the rise of the gig economy and remote working opportunities, many of us have to handle this crucial task on our own. Enter Robo-advisors—a revolutionary tool designed to simplify the complex world of retirement planning.

Demystifying Robo-advisors 🧐

Robo-advisors, as the name suggests, are automated online platforms that use algorithms to manage and allocate your investments. They typically invest in low-cost exchange-traded funds (ETFs) and are known for their simplicity, accessibility, and affordability. Essentially, they take on the role of a financial advisor but in a more automated, streamlined, and cost-effective manner.

The Benefits of Using Robo-advisors

In the following sections of this article, we will discuss the various advantages of using Robo-advisors, from their cost-effectiveness to their ease of use, and how they can help ensure you are well-prepared for your golden years. 🌅

Potential Drawbacks of Robo-advisors

As with any technology, Robo-advisors are not without their challenges. We will also explore some potential drawbacks, such as the lack of human touch and potential limitations in their investment strategies. 👀

How Robo-advisors can Help Secure Your Retirement

Finally, we will delve into how Robo-advisors can help you prepare for retirement. Whether you are in your 20s and just starting to think about retirement, or in your 50s and looking to boost your retirement savings, Robo-advisors can provide a valuable tool to help you reach your goals. 🎯

The financial landscape is changing, and with it, so are the tools we use to navigate it. Robo-advisors represent a new wave of financial technology designed to make investing and retirement planning accessible and manageable for everyone. So, whether you are a seasoned investor or just starting your financial journey, this guide will provide you with a comprehensive understanding of Robo-advisors and how they can help secure your financial future.

Now, let’s dive in and learn how you can leverage the power of Robo-advisors to secure your financial future and enjoy a comfortable retirement. 🚀

Understanding the Impact of Robo-Advisors on Your Retirement Planning

As we delve into the realm of financial planning for retirement, the role of Robo-advisors cannot be overlooked. These digital platforms provide algorithm-driven financial advice or investment management online with minimal human intervention. They provide efficient, low-cost services, and their rise in popularity over the last decade has been meteoric. So, let’s understand what they bring to the table.

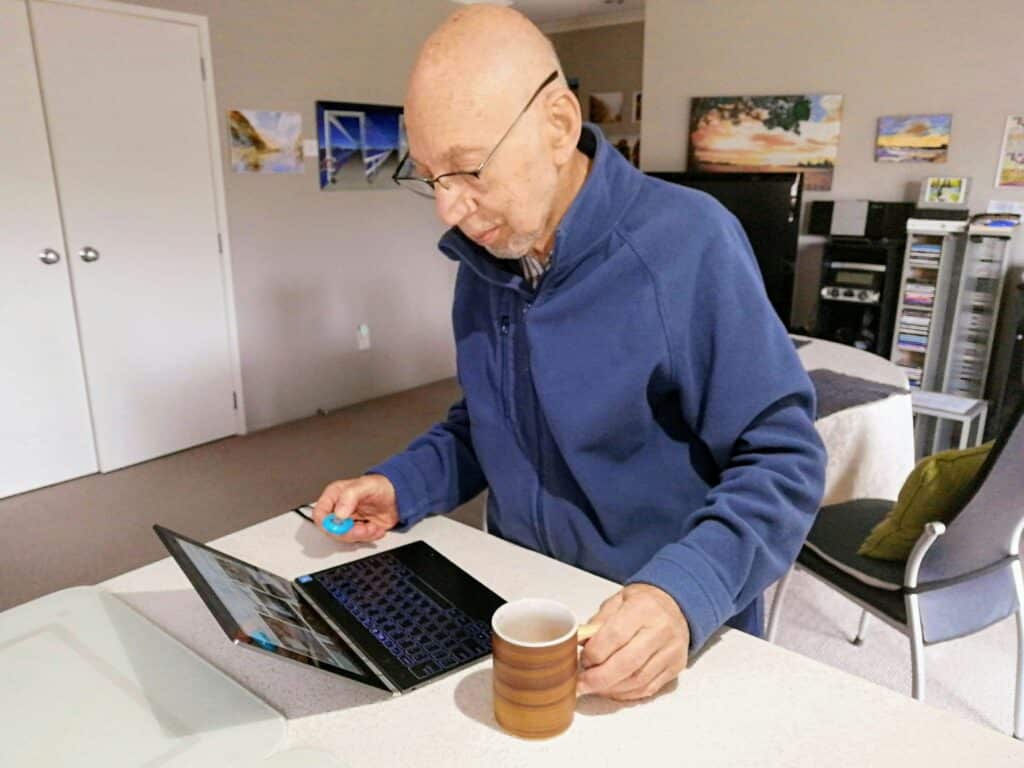

Most Robo-advisors work by asking clients a series of questions to understand their financial goals and risk tolerance. Then, they use this information to offer advice and automatically invest client assets. The key benefit is that these services can offer lower fees than traditional human advisors, and they can be used 24/7 from any location with an internet connection. This flexibility is especially useful for those planning for retirement, as it allows you to adjust your investment strategy as your life changes.

One of the main reasons Robo-advisors are gaining traction is because of the convenience they offer. They are usually more accessible and less intimidating than walking into a financial advisor’s office. This accessibility makes them a great option for those who are new to investing, particularly those starting to think about retirement. For a more in-depth understanding of how Robo-advisors function, watch the following video: “Robo-Advisors: How They Work And Their Role in Investing” by CNBC.

How Robo-Advisors Contribute to a Secure Financial Future

Robo-advisors are not just easy to use; they can also help optimize your retirement savings. Here’s how:

Automated Investment Management: Robo-advisors use algorithms to automatically manage and rebalance your investment portfolio. This helps to maintain an optimal asset allocation and can lead to better long-term investment returns.

Low-Cost Advice: Traditional financial advisors often charge high fees, which can eat into your retirement savings. Robo-advisors, on the other hand, typically charge lower fees, helping you save more for retirement.

Easy Access: Robo-advisors are typically accessible via a web browser or mobile app, making it easy for you to check your investments and make changes.

Take a look at the table below to compare the pros and cons of using a Robo-advisor:

| Pros | Cons |

|---|---|

| Low fees | Limited personal interaction |

| Automated investment management | Less customization than a human advisor |

| Easy access | May not handle complex financial situations |

Choosing the Right Robo-Advisor for Retirement Planning

As the market for Robo-advisors grows, so does the number of platforms available to consumers. Each has its unique features and services, which can make choosing one a challenging task. Here are some key factors to consider when choosing a Robo-advisor for your retirement planning:

Cost: Different Robo-advisors charge different fees. Some charge a flat annual fee, while others charge a percentage of assets under management. Consider which fee structure works best for you and your retirement planning goals.

Investment Options: Some Robo-advisors offer a limited range of investment options, while others offer a wide variety of asset classes. Make sure the Robo-advisor you choose provides the investment options you need for your retirement portfolio.

Additional Services: Some Robo-advisors offer additional services like tax-loss harvesting, access to human advisors, and automatic rebalancing. Consider which of these services are essential to you and your retirement planning.

If you’re interested in a comprehensive review of some popular Robo-advisors, check out the video “Best Robo-Advisors in 2022: Performance, Fees, and Features!” by The Investor Show.

Robo-Advisors: An Essential Tool for Retirement Planning

In conclusion, Robo-advisors can be a valuable tool for retirement planning. They offer convenient, low-cost financial advice and investment management. This accessibility and affordability make them a good fit for many people, especially those who are new to investing or who want a hands-off approach to their retirement planning.

But as with any financial decision, it’s essential to do your research before choosing a Robo-advisor. Consider the cost, investment options, and additional services each platform offers. And always keep your long-term retirement goals in mind.

As technology continues to evolve, it’s likely that Robo-advisors will continue to become an even more integral part of retirement planning. So, it’s worth taking the time to understand how they work and how they can help secure your financial future. Your future self will thank you!

Conclusion

In conclusion, we have traversed a comprehensive journey through the complex yet enthralling world of technology and engineering. We have delved into intricate details and unraveled numerous aspects that make up these expansive domains. Our exploration was fueled by a passionate desire to understand and comprehend the multifaceted dynamics at play.

We initiated our journey by understanding the basics of Information Technology and the essence of Software Engineering. These fundamental concepts, often taken for granted, lay the groundwork for the vast technological advancements we witness today. We comprehended how the amalgamation of these two domains has the potential to revolutionize the world, making our lives better in countless ways.

In the subsequent sections, we delved deeper into the nuances of these fields. We looked into the ins and outs of different programming languages and understood their importance in the software development process. We shed light on the significance of data structures and algorithms and how they streamline the programming process. These technical details, though might seem overwhelming initially, are the building blocks of any successful software project.

We also explored the fascinating world of artificial intelligence, machine learning, and data science. These emerging technologies, though in their infancy, are already shaping the future of the tech industry. We touched upon their potential applications and how they can revolutionize sectors like healthcare, finance, and entertainment.

The journey also encompassed an understanding of important practices like Agile and DevOps. These methodologies are reshaping how software development is approached, making the process more efficient and collaborative.

Undoubtedly, the subject matter was extensive and exhaustive. However, I hope this exploration has sparked your curiosity and fueled your thirst for knowledge. I encourage you to delve deeper into these subjects, share your thoughts, and engage with the content. This not only helps in reinforcing the concepts but also promotes an environment of learning and sharing.

As we conclude, remember that the world of technology is constantly evolving. It requires us to be lifelong learners, constantly adapting and staying updated with the latest developments. Let this exploration be the foundation upon which you build your understanding and skills.

If you have any questions or wish to delve deeper into any specific topic, feel free to leave a comment below. I would love to hear your thoughts and engage in a stimulating discussion. Also, please share this article with others who might find it useful. Your sharing helps in spreading knowledge and fostering a community of learners.

In the pursuit of knowledge, resources like W3Schools and Mozilla Developer Network can be immensely helpful. For more advanced topics, you might find Google AI Hub and arXiv useful.

Remember, every bit of knowledge acquired is a step forward in your journey. Keep learning, keep sharing, and let’s continue to explore this fascinating world of technology together. 🚀

Thank you for joining me on this journey and I look forward to our continued exploration in the vast realms of technology and engineering. 🙏

References:

[1] W3Schools

[2] Mozilla Developer Network

[3] Google AI Hub

[4] arXiv