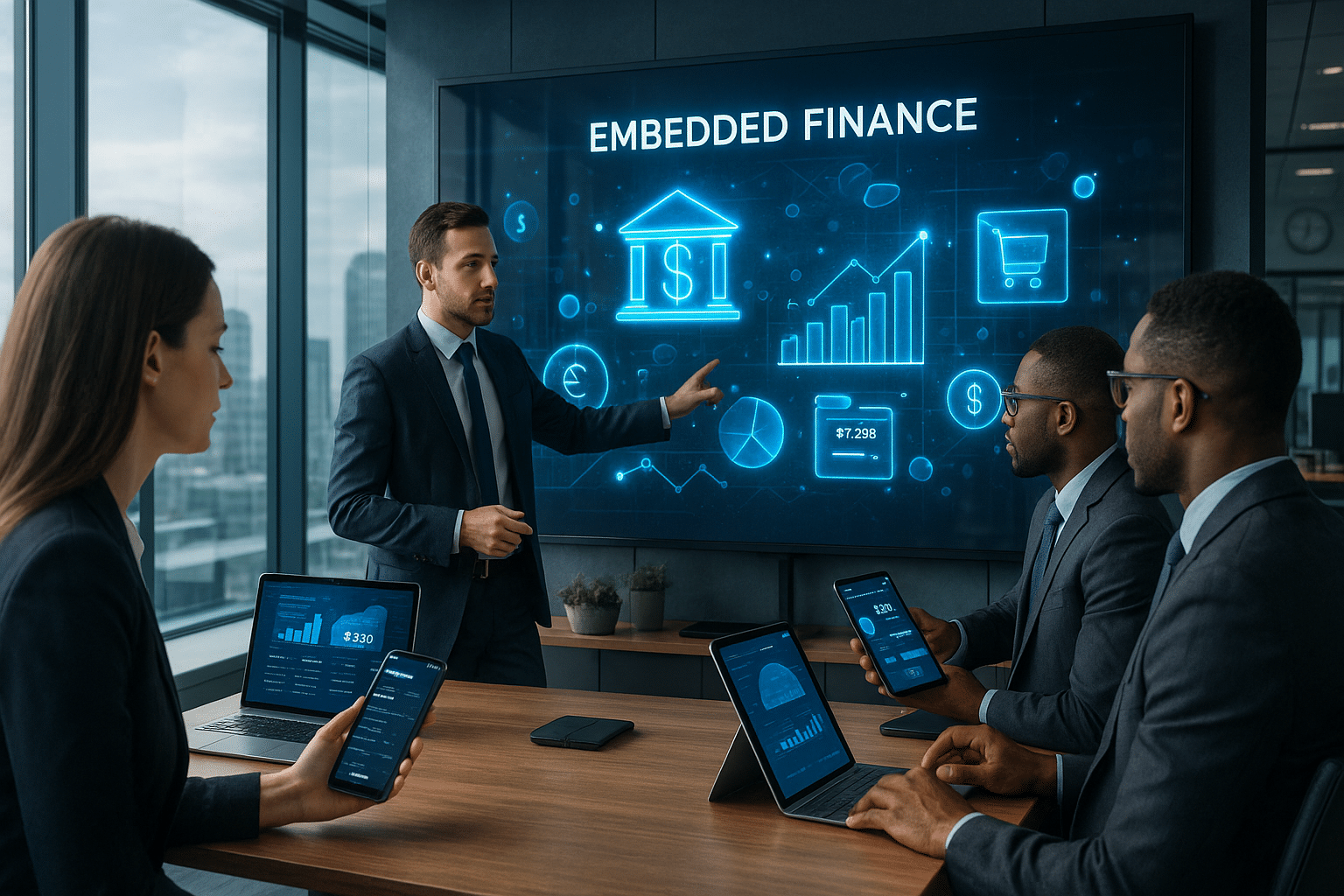

In a world where innovation is the new norm and digital transformation is not just a trend, but a necessity, a concept has recently taken the financial landscape by storm – Embedded Finance. This revolutionizing concept is reshaping our traditional banking system and transforming the way we transact. But what is Embedded Finance, and why does it matter?

Embedded Finance is the seamless integration of financial services into non-financial platforms, making it possible for businesses to offer financial products directly to their customers without the need for a traditional bank. 💡 It’s like having a bank right within your favorite app! But this is just the tip of the iceberg. There’s so much more to Embedded Finance than meets the eye.

In this comprehensive article, we’ll dive deeper into the realm of Embedded Finance, unveiling its power and exploring how it’s revolutionizing the financial ecosystem. We’ll dissect this concept from all angles, covering its meaning, benefits, impact, and potential future trends. Whether you are a tech enthusiast, a financial professional, or an entrepreneur eager to explore new opportunities, this is the read for you. 🚀

Understanding the Power of Embedded Finance

Embedded Finance is not just a buzzword, but a powerful force that’s driving innovation in the banking and financial industry. 🌐 But to truly understand its potential, we must break it down to its core components. We’ll begin by defining Embedded Finance, exploring its key principles and the technology that underpins it.

The Impact of Embedded Finance

Embedded Finance is not just changing the way we bank and transact, but also shaping businesses and consumer behavior. 🔄 It’s about more than just convenience—it’s about offering a streamlined, efficient, and user-centric financial experience. We’ll delve into the far-reaching implications of Embedded Finance and discuss how it’s redefining the boundaries of the traditional banking system.

Benefits of Embedded Finance

Why are businesses jumping on the Embedded Finance bandwagon? What benefits does it bring to the table? 💼 From increased revenue opportunities to enhanced customer experience, Embedded Finance has a lot to offer. We’ll explore the benefits of Embedded Finance for businesses, consumers, and the financial industry at large.

Future Trends in Embedded Finance

Where is Embedded Finance headed? What does the future hold for this dynamic concept? 🧭 We’ll investigate emerging trends in Embedded Finance, discussing how they could shape the future of banking and financial transactions.

Are you ready to embark on this exciting journey? As we delve into the world of Embedded Finance, we’ll discover how it’s disrupting the status quo, bringing about profound changes in the financial industry, and opening up new opportunities for businesses and consumers alike. Join us as we unveil the power of Embedded Finance and its potential to revolutionize the way we bank and transact. 🌟

🚀 Unleashing the True Potential of Embedded Finance

As we navigate the waves of digital transformation, a new and powerful trend has emerged, called Embedded Finance. This novel approach is steadily revolutionizing how we bank and transact, melding financial services with traditionally non-financial platforms. In this piece, we delve into the nitty-gritty of Embedded Finance and its transformative power.

💼 Understanding Embedded Finance

Embedded Finance is an innovative concept where financial services are integrated directly into non-financial platforms or services. Simply put, it’s about embedding banking capabilities like payments, lending, insurance, or investment services directly into the customer journey of non-financial businesses such as retail, ride-hailing apps, or social media platforms.

This model seeks to bridge the gap between financial and non-financial services, creating a seamless and holistic customer experience. It opens up a plethora of new revenue streams and business models for companies, enhancing their ability to deliver value to customers.

To get a more visual understanding of this concept, consider watching “Embedded Finance Explained” on the FINTECH Circle YouTube channel. It provides a comprehensive overview of the topic, highlighting its key facets and potential impact.

📈 The Rise of Embedded Finance

Embedded finance is not a sudden phenomenon; it is the result of years of technological advancement and a growing demand for seamless, digital-first financial services. This shift has been further accelerated by the recent global pandemic, forcing businesses to rethink their operations and customer service strategies.

Furthermore, the rise of fintech companies that specialize in creating APIs (Application Programming Interfaces) that allow easy integration of financial services has facilitated the growth of embedded finance. These APIs are the building blocks that enable non-financial platforms to embed banking capabilities.

Looking at the bigger picture, embedded finance represents a massive market opportunity. A report by Lightyear Capital estimates that the global Embedded Finance market could reach $3.6 trillion by 2030. With such massive potential, it’s clear that embedded finance is more than just a buzzword; it’s a transformative force in banking and transactions.

💡 Benefits and Implications of Embedded Finance

Embedded Finance offers numerous benefits for both businesses and consumers. For businesses, it provides an opportunity to increase revenue, enhance customer experience, and foster customer loyalty. On the other hand, consumers benefit from seamless, convenient, and personalized financial services.

| Benefits for Businesses | Benefits for Consumers |

|---|---|

| New revenue streams | Seamless financial services |

| Improved customer loyalty | Convenient transactions |

| Enhanced customer experience | Personalized offerings |

It’s worth noting that the adoption of embedded finance could have significant implications for traditional banking institutions. With non-financial platforms providing financial services, banks risk being sidelined. To stay relevant, they need to innovate and perhaps consider partnerships with fintechs to offer their own embedded finance solutions.

🔍 Key Players and Use Cases of Embedded Finance

The world of embedded finance is rich with examples of successful applications, and several major players are leading the charge. From tech giants like Amazon and Uber to innovative startups, numerous companies are leveraging the power of embedded finance to deliver value to their customers.

Consider Amazon’s “Buy now, pay later” service, which allows customers to split their purchases into installments. This service, powered by embedded finance, enhances the customer shopping experience by providing a convenient payment option.

Similarly, Uber has integrated a digital wallet, Uber Cash, into its platform. This enables users to pay for rides and food deliveries seamlessly, proving that embedded finance can offer tangible benefits in everyday life.

For a more in-depth look at these use cases, I recommend watching the video “Embedded Finance: Use Cases and Challenges” by the Fintech Finance YouTube channel. It provides valuable insights into how businesses are successfully implementing embedded finance.

🔮 The Future of Embedded Finance

As we look towards the future, it’s clear that the potential of embedded finance is immense. The ability to integrate financial services into any app or platform can fundamentally change how businesses operate and how consumers interact with financial services.

In the future, we can expect to see even more innovative applications of embedded finance. We might see embedded finance in the Internet of Things (IoT), where appliances could automatically reorder supplies when they run out, or in social media platforms, where users could make purchases without ever leaving the platform.

While the future of embedded finance is undoubtedly exciting, it also presents certain challenges. Issues such as data privacy, regulatory compliance, and the need for seamless integration will need to be addressed. However, with continuous technological advancements and an increasing appetite for digital financial services, the possibilities are endless.

Conclusion

In conclusion, we’ve traversed a comprehensive journey, deciphering and exploring the multifaceted world of software engineering and information technology. Our expedition into the core of these intriguing, yet complex concepts and principles, has been illuminating, sparking a greater understanding and appreciation for the importance of this field in today’s technological and digital landscape.

We commenced our journey with a deep dive into the heart of software engineering, touching upon its fundamental elements, components and the various methodologies utilized within the field. We laid a strong foundation for comprehension, enabling us to further delve into the intricate complexities of the subject, detailing and expounding upon the importance of software development processes and life cycle management, the criticality of quality assurance, and the principles of systems design.

From there, we moved into the realm of information technology, exploring its interconnection with software engineering, and its vital role in today’s digital world. We delved into the importance of data management and network communications, and the significance of IT security and ethical considerations in an increasingly interconnected world.

Let’s not forget the indispensable role of programming languages, and their inherent importance in building and maintaining software applications. We discussed the pros and cons of various programming languages, their applicability in different scenarios, and the future trends to watch out for in this realm. This offers a great opportunity to decide which language best suits your career path or project requirements.

This vast, yet enriching journey was designed to provide you, the reader, with a comprehensive understanding and knowledge base in these domains. Yet, learning is a never-ending journey. The realms of software engineering and IT are ever-evolving, and it is paramount to stay abreast of the latest trends and advancements.

It is my hope that this information has been beneficial and enlightening, sparking further interest and curiosity in these topics. I encourage you to take what you’ve learned and apply it, whether in your professional pursuits, academic endeavors, or personal projects.

Feel free to leave your comments, thoughts, and questions below. Your engagement and interaction greatly enrich our collective learning experience. Please also consider sharing this article with others who may find it informative and useful.

Continuing your exploration into these topics, you might find the following resources helpful for further reading:

1. Association for Computing Machinery (ACM)

2. Institute of Electrical and Electronics Engineers (IEEE)

3. IEEE Computer Society

Remember, the more we know, the more we realize how much there is to know. Let’s keep learning and growing together. 👨💻📚🚀

References:

1. Sommerville, I. (2015). Software Engineering. Addison-Wesley.

2. Stallings, W. (2016). Data and Computer Communications. Pearson.

3. Sebesta, R. W. (2015). Concepts of Programming Languages. Pearson.