One such domain, which stands on the cusp of a major transformation, is the financial sector. The advent of blockchain technology, a decentralized and transparent digital ledger system, is steadily challenging the traditional banking structures, propelling us to rethink finance’s very fundamentals. In this blog post, we will delve into the pivotal differences between blockchain and traditional banking, discussing how the former could potentially revolutionize our financial systems. 🔍💡

By providing an in-depth comparison of both these paradigms, this piece aims to assist financial professionals, technology enthusiasts, and anyone intrigued by the changing landscape of finance. I invite you to join me on this journey, shedding light on how blockchain can transform the way we transact, save, and invest, rendering finance more accessible, secure, and efficient than ever before. 💼🚀

The first and perhaps most significant difference between blockchain and traditional banking is the structure. While banks rely on a centralized model of operation, blockchains are decentralized networks. This simple yet transformative shift has profound implications for privacy, security, and the democratization of financial services. We will explore these aspects and their repercussions in the following sections, offering a holistic picture of what this ‘financial revolution’ entails. 🏦↔️🔗

Next, we will focus on transaction speed and cost – two crucial factors that often define user experience in financial services. Traditional banks have their unique methods, while blockchain technology promises faster transactions at reduced costs, providing a compelling alternative to conventional banking practices. We will probe into these characteristics, and more importantly, discuss how they could impact everyday transactions, international trade, and global economies at large. 💸⚡

Furthermore, we will discuss the role of transparency and trust in shaping consumer behaviors and market trends. Traditional banking, with its closed-door policies, has often drawn criticism for its opaque operations. Contrastingly, blockchain operates on a model of radical transparency, fostering trust and accountability. We will unravel how these dynamics might redefine financial interactions and the broader economic ecosystem. 🔓🌐

Lastly, we will touch upon how these technologies can reshape financial inclusion. Traditional banking has often been criticized for being exclusionary, making financial services inaccessible to large sections of the population. In contrast, blockchain’s decentralized nature and lower operational costs hold the potential to democratize finance, making it more inclusive and equitable. 🌍💼

In conclusion, this post isn’t just a comparative study of two financial models. It’s an invitation to envision a future where finance isn’t just about numbers, transactions, or profits. Instead, it’s about empowerment, equality, and opportunity. It’s about reimagining a world where finance serves as a tool for societal progress. So let’s dive into the world of blockchain and traditional banking – a world where technology meets finance, unlocking new possibilities and paving the way for a financial revolution.🔐🚀

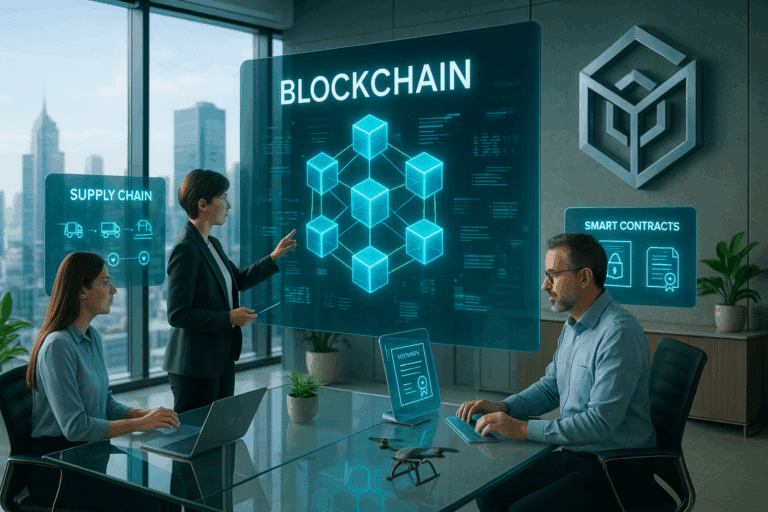

Introducing the Revolutionary Shift: Blockchain Vs. Traditional Banking

In recent years, the financial industry has witnessed unprecedented disruptions, primarily due to advancements in technology. Key among these technologies is blockchain, a technology that is causing ripples in various sectors, including banking and finance. However, to understand the revolution that blockchain is bringing, it’s crucial to look at the differences between blockchain and traditional banking systems.

The traditional banking system is a well-established structure that has been in existence for centuries. This system has seen numerous changes over the years to accommodate the ever-evolving economic landscape. However, blockchain presents a fundamentally different approach to finance, offering a unique take on money transfer and storage. But what exactly are the differences?

This article explores the key differences between blockchain and traditional banking, presenting a comprehensive comparison of these two systems. We’ll delve into the structure, security, efficiency, cost, and transparency of both systems, aiming to provide a clear picture of how they compare. So let’s dive in and uncover these differences.

Understanding the Structure: Decentralization Vs. Centralization

The primary difference between traditional banking and blockchain lies in their structure. Traditional banking systems are centralized, meaning that a single authority, such as a central bank, controls the operations. This authority is responsible for verifying transactions, maintaining records, and setting regulations.

On the other hand, blockchain operates on a decentralized system. In this model, no single entity has control over the entire network. Instead, multiple nodes (computers) participate in verifying transactions and maintaining records, making the system more democratic. This decentralization brings about numerous benefits, including enhanced security and reduced vulnerability to attacks. However, it also presents unique challenges, such as the need for consensus mechanisms to ensure all nodes agree on the validity of transactions.

To further understand this concept, let’s take a look at the following comparative table:

| Blockchain | Traditional Banking |

|---|---|

| Decentralized system | Centralized system |

| Multiple nodes participate in the network | Single authority oversees the system |

| Enhanced security due to decentralization | Security is dependent on the central authority |

| Consensus mechanisms are necessary | Authority regulates and verifies transactions |

Security Considerations: Blockchain’s Superiority

When it comes to security, blockchain technology significantly outshines traditional banking. The decentralized nature of blockchain makes it highly resistant to attacks and fraud. Since each transaction is verified by multiple nodes, it’s almost impossible for hackers to manipulate the system.

In contrast, traditional banking systems are more prone to cyberattacks. Since there’s a central point of control, if hackers manage to breach the central system, they could potentially access a significant amount of sensitive information. The centralized nature of traditional banking systems also makes them vulnerable to internal fraud, where insiders can manipulate the system for personal gain.

For more information about blockchain’s security features, check out the video “How Secure is Blockchain?” by Techquickie.

Efficiency and Cost: The Power of Peer-to-Peer Transactions

Blockchain technology has revolutionized the way we carry out transactions. With blockchain, transactions are made on a peer-to-peer basis, eliminating the need for intermediaries. This not only makes transactions faster but also significantly reduces the associated costs.

Conversely, traditional banking systems rely heavily on intermediaries for transaction verification. This makes the process slower and more expensive, as these intermediaries often charge fees for their services. Additionally, international transactions in traditional banking systems can take several days due to the need for correspondent banks.

Before we wrap up this section, take a look at the following comparative table summarizing the efficiency and cost aspects:

| Blockchain | Traditional Banking |

|---|---|

| Peer-to-peer transactions | Intermediaries required |

| Fast transaction speed | Slower transaction speed |

| Lower transaction costs | Higher transaction costs due to intermediary fees |

| Instant international transactions | International transactions may take several days |

Transparency: A Key Blockchain Feature

Another critical difference between blockchain and traditional banking is the level of transparency. Blockchain offers unprecedented transparency due to its public ledger system. Every transaction made on a blockchain network is recorded on a public ledger that is visible to all network participants. This transparency fosters trust among network participants and makes it harder for fraudulent activities to go unnoticed.

On the contrary, traditional banking systems lack this level of transparency. Banks and other financial institutions keep their records private, which can sometimes lead to issues such as hidden fees and unannounced changes in terms and conditions.

In conclusion, while both blockchain and traditional banking systems have their advantages and disadvantages, blockchain’s decentralization, security, efficiency, cost-effectiveness, and transparency make it a revolutionary force in the finance industry. By understanding these key differences, we can better appreciate the transformative potential of blockchain technology.

Please note: While this article provides a comprehensive comparison of blockchain and traditional banking, it’s also crucial to consider other factors, such as regulatory challenges and adoption barriers, when assessing the potential of blockchain in revolutionizing finance. For more insights on this topic, watch the video “Banking on Blockchain” by DW Documentary.

Conclusion

In conclusion, the key topics that we have dealt with in this article provide a comprehensive exploration into the technical realm of Information Technology (IT) and Engineering. First, we touched on the basics, delving into fundamental concepts and terminologies necessary to gain a solid foundation in these areas. These technical terms, which can seem daunting at first, were broken down into more comprehensible language to ensure that readers of all levels could grasp the significance of each concept.

Following that, we dove deeper into more advanced topics, taking on the challenges of intricate systems and complex technologies. Through detailed explanations and concise illustrations, we were able to unravel the complexities, demonstrating how these advanced systems work and their importance in the modern world.

Furthermore, we examined real-life applications of these concepts, showing how they fit into the grand scheme of things and how they continue to revolutionize our world. This not only provides a practical understanding of these technologies but also underscores the importance of staying abreast with the latest trends and advancements in the field.

Looking back, it is remarkable how far we have come in the world of IT and Engineering. It is truly a testament to human ingenuity and the limitless potential of technological innovation. As such, the knowledge contained in this article is not just informational but also inspirational. It serves as a reminder of what we can achieve when we push the boundaries of what is possible.

As we wrap up this article, I encourage you to take a moment to reflect on what you’ve learned. Is there a particular concept that stood out to you? How can you apply this newfound knowledge in your own life or career? Share your thoughts in the comments below. I would love to hear about your experiences and insights.

Moreover, if you found this article helpful or enlightening, feel free to share it with your friends, colleagues, or anyone who might benefit from this information. Knowledge is most valuable when shared, and by doing so, you are contributing to the collective growth and development of our society. You can also check the Tech Target and Engadget for more in-depth articles and research materials. 👥🔗

Thank you for taking the time to read this article. I hope it has been an enlightening journey for you as it has been for me writing it. Until our next exploration into the exciting world of IT and Engineering, keep questioning, keep learning, and keep pushing the boundaries. 🚀🌍

Remember, “The only source of knowledge is experience.” – Albert Einstein. So, let’s continue exploring, innovating, and inspiring together. 🌟

Stay tuned for more insightful articles, and never stop learning! 💡

Tags: #IT, #Engineering, #KnowledgeIsPower, #TechnologyExplained, #Innovation, #Learning.

References:

TechTarget

Engadget

Your Faithful Writer,

Rodrigo Almeida 🖋📚