Robo-Advisors: Short vs. Long-Term

Financial planning is a nuanced process, demanding the seamless blend of individual aspirations, market trends, and the inevitable element of risk.

Financial planning is a nuanced process, demanding the seamless blend of individual aspirations, market trends, and the inevitable element of risk.

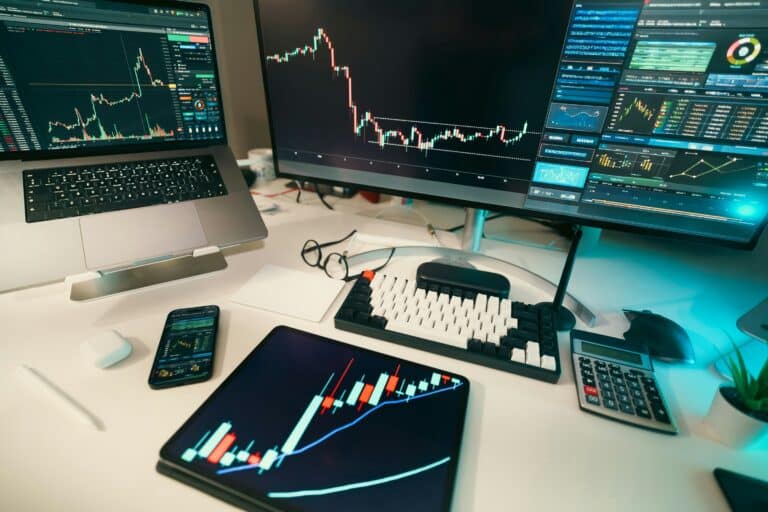

In a digital-first era where everything, from shopping to socializing, has gone online, it's no surprise that even our finances have followed suit.

In the fiercely competitive world of investments, mastering the delicate art of portfolio rebalancing is akin to finding the proverbial needle in the haystack.

In the current digital era, achieving financial autonomy has become a desired goal for many.

Are you feeling left behind by the fast-paced financial world?

Imagine having a highly skilled investment guru at your fingertips, 24/7, continuously strategizing to help you reach your financial goals.

Imagine stepping into a new era of financial autonomy, where the power to shape your financial future is literally at your fingertips.

Picture a world where your hard-earned money is efficiently managed, investments meticulously calculated, and financial risks thoroughly assessed - all without human intervention.

As we stand on the precipice of the Fourth Industrial Revolution, the financial industry is not immune to the sweeping changes brought about by technological advancements.

Embarking on the investment landscape can often feel like trying to navigate a labyrinth in the dark 😖.